De prestaties van de grootste internetbedrijven van China in 2023

Sources: LatePost and Techbuzzchina.substack.com

In this article we have summarized the developments of China’s most important internet companies in 2023, both in terms of daily active users, market valuation and stock price, but also regarding their challenges and problems in 2023.

During the three years of the pandemic, many Chinese internet companies implemented cost-cutting measures and efficiency improvements to cope with the challenges of business stagnation and difficult financing. Especially since the summer of 2021, the competition in the internet industry seemed to calm down, and the market appeared to be in shock. However, behind the scenes, industry giants did not stop their internal restructuring and business explorations.

The results of the competition that had been brewing during the three years of the pandemic became evident in 2023. ByteDance not only surpassed Alibaba in advertising revenue, but also exceeded Tencent in overall revenue. Pinduoduo’s market value surpassed Alibaba’s, becoming both a nightmare and a role model in the e-commerce industry. Alibaba, in turn, embarked on a year-long extensive restructuring.

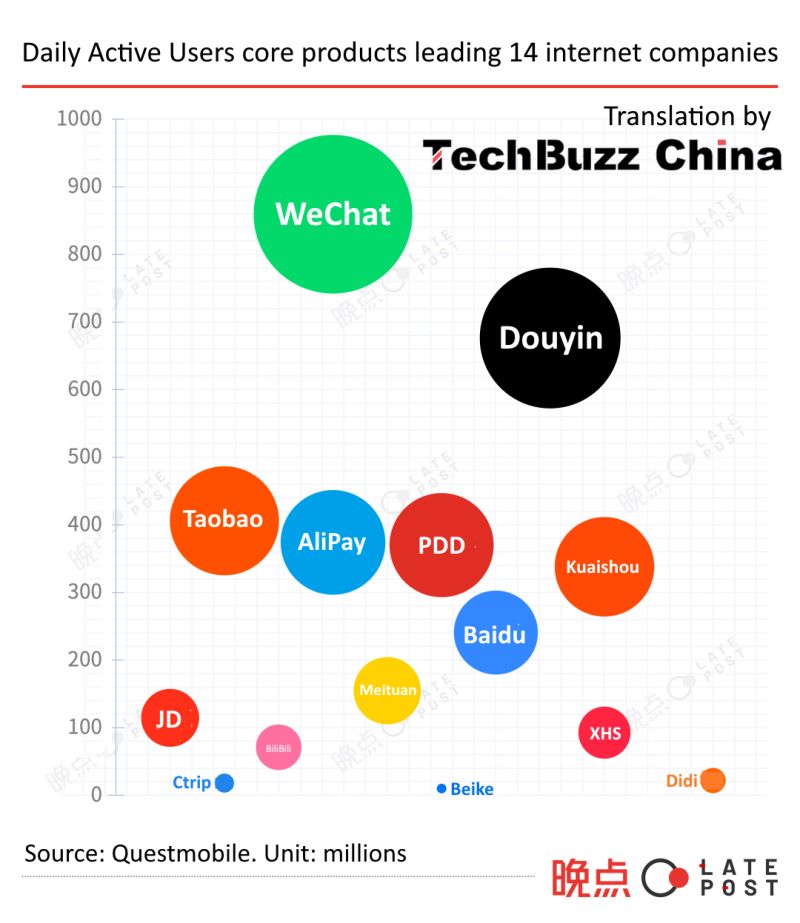

In the above graph, the number of daily active users of the leading apps of the 14 biggest players is shown, demonstrating their reach, stickiness and monetisation ability through advertising, e-commerce, local services, etc. WeChat (owned by Tencent) and Douyin (owned by ByteDance) have the highest number of daily active users, followed by Taobao (Alibaba), Alipay and Pinduoduo.

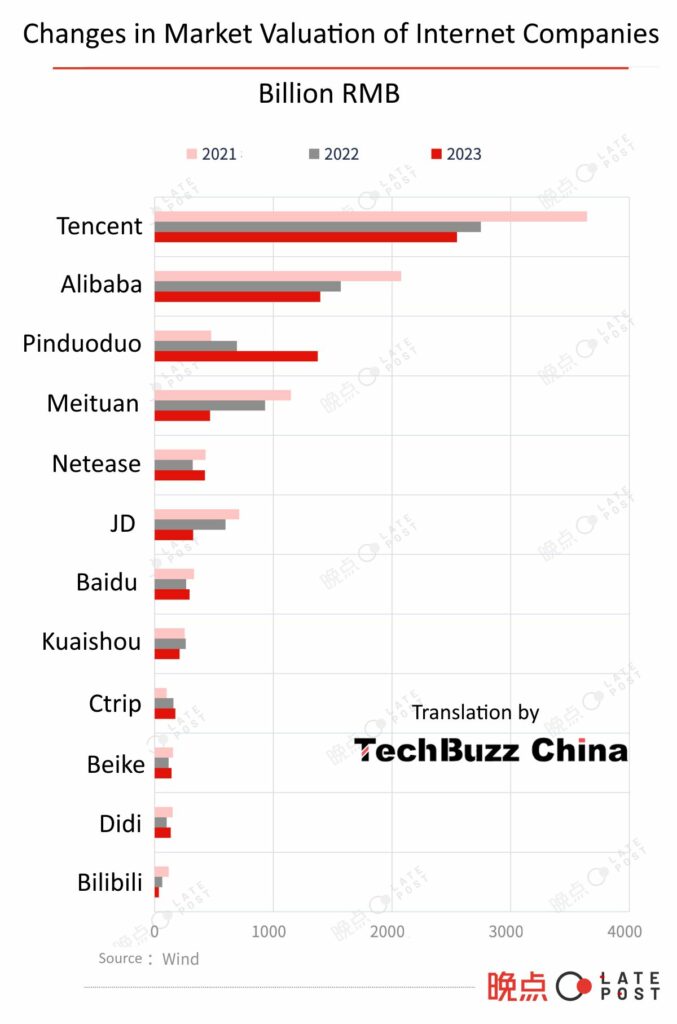

The total market value of the top ten listed Chinese Internet companies was US$934.8 billion, a US$244.2 billion decrease from the beginning of 2023. Financing channels continue to dry up and competition shows no signs of slowing down. As can be seen from the below graph, Tencent is still the biggest in terms of market valuation. Pinduoduo showed an impressive 80% rise in 2023, while its e-commerce competitors (Alibaba and JD to name a few) ran into more intense competition and lost much value. No wonder both companies are now trying to be more like Pinduoduo to win back consumers. A few companies recovered in 2023 thanks to the end of the zero-covid policy (Ctrip) and relaxing government scrutiny (Didi). Bilibili and Didi have dropped out of the top ten and are now on 11th and 12th place in terms of market valuation.

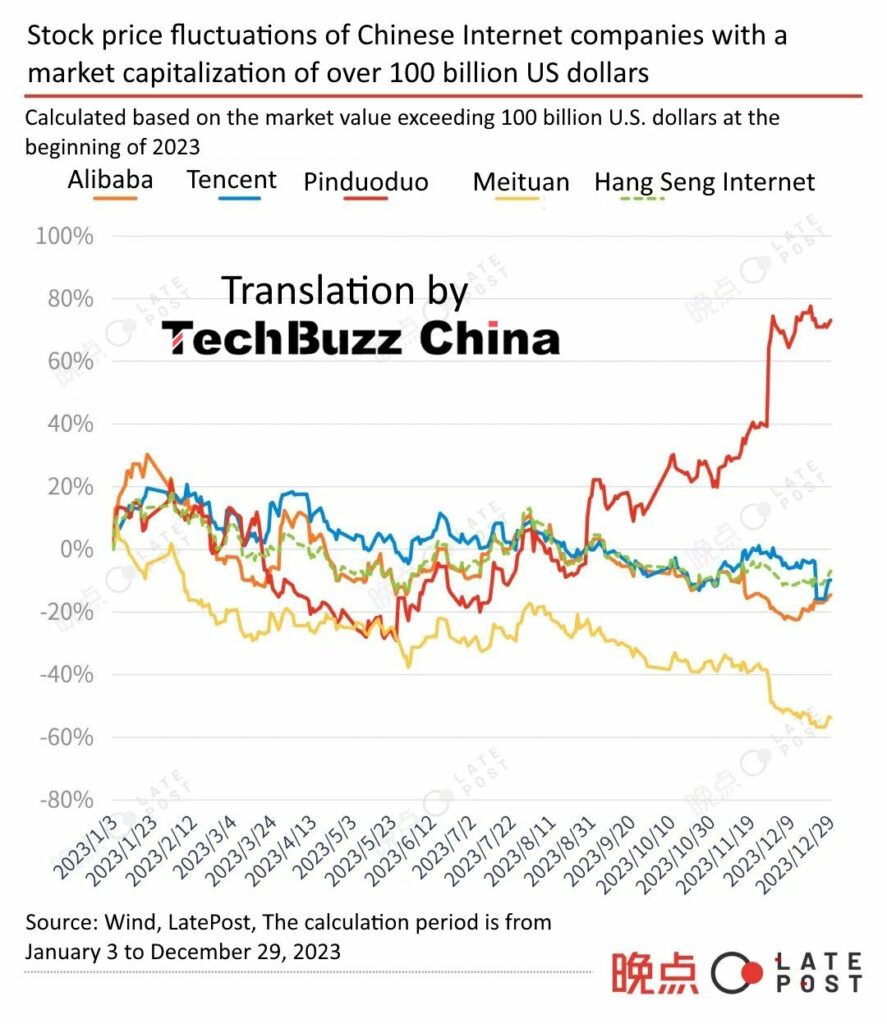

The below graph shows the market valuation developments during the year 2023. Pinduoduo’s stock price exploded in 2023. Also Meituan stands out (in a negative way), now that it is being attacked by Douyin in its core business of in-store and hotel & travel local services.

Now we look at each internet company individually.

ByteDance diversified into various fields during the pandemic, including VR, education, games, cloud computing, and enterprise services. However, realizing the need to refocus, ByteDance made drastic decisions in 2023, shrinking its VR and game units, laying off staff, and concentrating on content platform commercialization. Douyin’s e-commerce remained strong, contributing significantly to advertising revenue, but ByteDance acknowledged the challenges of maintaining growth in the increasingly competitive market. Douyin’s venture into lifestyle services faced hurdles, struggling to compete with Meituan in food delivery and experiencing limitations in expanding into instant retail businesses.

Tencent: In the first half of 2023, Tencent celebrated a return to double-digit growth in revenue and profits after two years of challenging adjustments. Amid transformations in core gaming and enterprise services, Tencent re-engaged in e-commerce to boost advertising revenue, leveraging short videos for live broadcast e-commerce. Tencent also reconciled with rivals, fostering rapid growth in e-commerce advertising and resuming cooperation with Douyin for game promotions.

Alibaba: Since Alibaba announced the “1+6+N” change in March 2023, the year-long reorganization faced challenges. Businesses like Cainiao, Hema, and Alibaba Cloud experienced hurdles in their planned listings. Key positions in Alibaba underwent significant changes and, once aspiring to dominate various sectors, Alibaba is now dividing core and non-core businesses, with a stock price decline and market value surpassed by Pinduoduo in 2023.

Pinduoduo has become an example and at the same time a nightmare for its competitors. The community group buying business grew significantly in China, and overseas venture Temu expanded to nearly 50 countries, accumulating 270 million users and a GMV of almost $18 billion. Pinduoduo’s success prompted competitors like Alibaba, JD.com, Meituan, TikTok Shop, SHEIN, and AliExpress to adopt similar strategies, but Pinduoduo’s unique focus on efficiency, simplifying the shopping experience and compressing profit levels, remains challenging for rivals to replicate. However, the pursuit of efficiency over fairness, such as the “refund only” policy, raises questions about its impact on the business environment.

NetEase became China’s fourth-largest internet company by market value, surpassing Meituan. This shift is attributed to NetEase’s robust performance in the gaming sector. NetEase Games’ success is rooted in understanding the evolving gaming industry and leveraging platforms like Douyin and Bilibili for increased traffic. Globally, NetEase ranks second in mobile game revenue, emphasizing its dominance and adaptability in the competitive gaming market.

Meituan: In 2023, Meituan faced a challenging year as Douyin emerged as a tough competitor, prompting Meituan to adopt strategies like adjusting merchant rates and increasing marketing budgets. Due to Meituan’s core food delivery business showing weaknesses, the company announced significant restructuring, integrating previously independent business groups and platforms to enhance synergy and focus on stabilizing the main business amidst fierce competition.

Shein: Before the 2020 pandemic, Shein was relatively unknown, today the company is a global retail force. Shein strategically leveraged China’s robust supply chain capabilities, coupled with. However, as scrutiny intensified and Shein faced regulatory pressures in China and abroad, it ventured beyond its safe zone. In response to challenges from competitors like Temu, Shein expanded its platform model globally, acquired equity in American clothing brands, and raised $2 billion in a financing round. While its 2023 net profit exceeded $2.5 billion, Shein faces the broader challenge of navigating a de-globalized world amid geopolitical tensions.

JD.com shifted focus back toward cost saving, efficiency, and experience in 2023. In response to cost concerns, JD.com no longer requires merchants to use JD Logistics, and “JD Factory-operated stores” will be distributed by manufacturers. The strategic changes come amid challenges from competitors, such as Pinduoduo.

Kuaishou: In 2023, Kuaishou achieved its first profit since its listing. The platform’s daily active users reached a record high of 386 million. Shifting its e-commerce focus from Douyin to Pinduoduo, Kuaishou aims to learn from Pinduoduo’s low price approach for user profiles similar to its own. Kuaishou also restructured its commercialization and e-commerce divisions for better collaboration and overall GMV improvement.

Ant Group: Ant Group’s application for a change in its actual controller was approved at the end of 2023. The change reduces Jack Ma’s voting rights from 53.46% to 6.2%, eliminating an actual controller for Ant Group. Ant Group made significant adjustments following the 2020 IPO suspension, adhering to regulatory requirements, increasing capital, and establishing Ant Consumer Finance to undertake compliant business.

Baidu: Despite a year of intensive investment, Baidu’s Large Language AI Model, Wenxin 4.0, is perceived by some practitioners as falling short of rival models like GPT-4.

Ctrip: In 2023, Ctrip, the largest online travel and air ticket booking platform in China rapidly recovered from cumulative operating losses in the 3 ‘pandemic years’, accelerated by domestic hotel bookings surpassing pre-pandemic levels, and robust air ticket booking revenue.

Beike Home Search is managed to achieve record profits in a challenging real estate market, with China experiencing its lowest new home transaction volume in eight years. This highlights the company’s resilience and momentum for growth in a fragile real estate market.

Xiaohongshu: faces challenges in user growth as its core strategy of creating “usefulness” reaches a saturation point, especially in lower-tier cities where users have limited demand for such products. Additionally, Xiaohongshu is focusing on differentiated live broadcast e-commerce and aligning its advertising business more closely with transactions to prove its ability to facilitate transactions for merchants.

Didi, China’s largest ride-hailing platform, faced mixed fortunes as it returned to the market in January 2023 after an 18-month cybersecurity review. The average daily order volume in China’s online ride-hailing market for 2023 increased, yet individual drivers faced a decrease in orders and income due to increased competition.

Bilibili, a leading Chinese online entertainment platform, entered its profitability assessment period in 2024. Bilibili is focusing on its live broadcast and advertising business to boost revenue. However, balancing monetization pressures from investors and user experience poses challenges for the platform in the coming year.

Geïnteresseerd in onze diensten?

We zijn beschikbaar voor je vragen. Je kan ons ook contacteren voor een gratis consultatiegesprek van één uur.

Contacteer ons